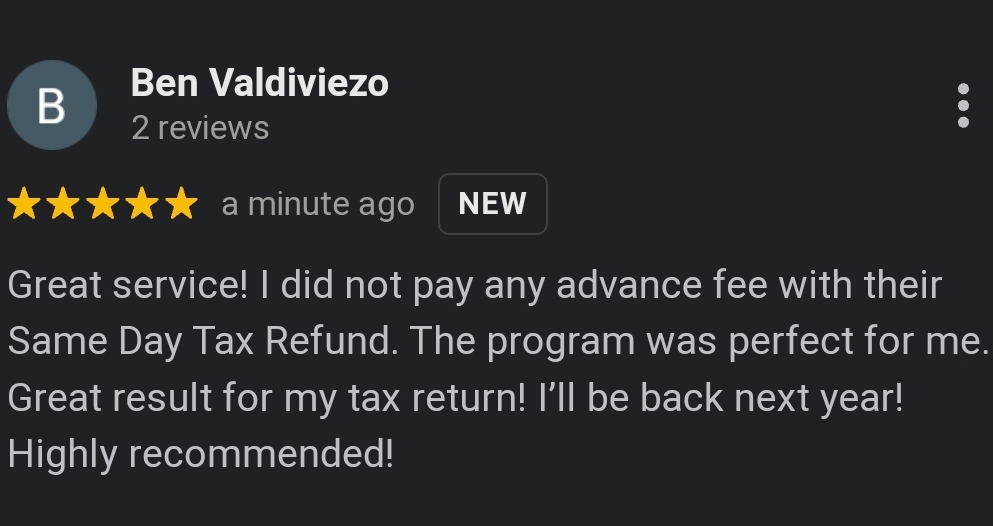

Q: Do you offer “same-day rapid refunds?”

A: YES! We offer clients refund advances up to $6,000, the same day they file. Print refund checks in our office, prepaid debit cards, direct deposits, and more.

Q: Is the tax preparation charge determined by the amount of the refund?

A: NO! The cost to prepare your return should not be based on the amount of your refund.

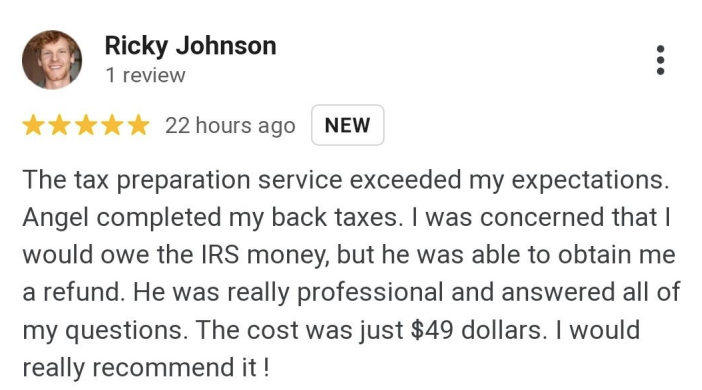

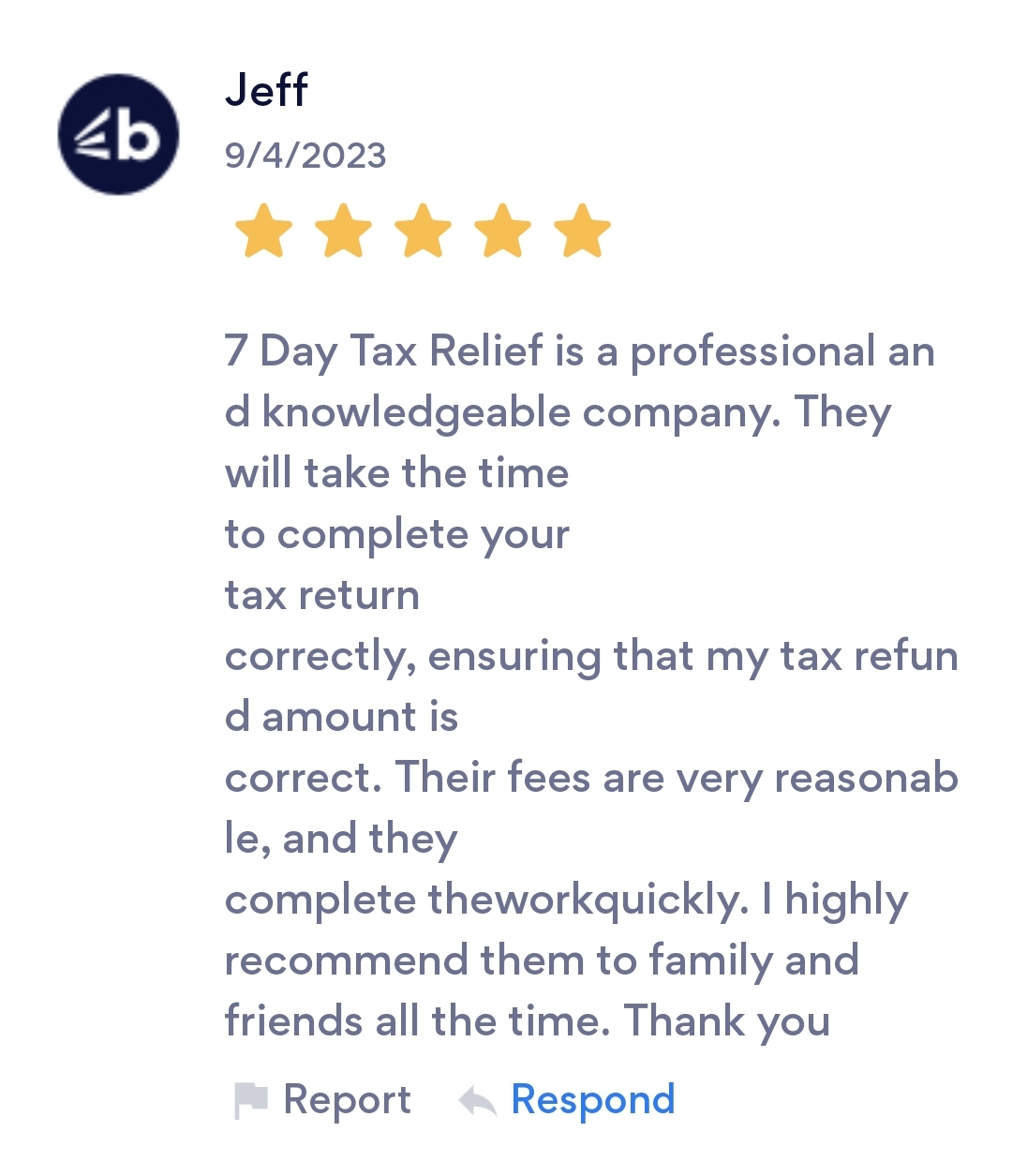

Q: How much do you charge?

A: $49 is our starting fee but It is impossible to answer this question accurately without knowing all that is required for your specific return. We charge a flat fee based on the complexity of your return. We have evaluated the complexity, knowledge, liability and preparation time involved with each possible form on a tax return, have assigned each form a value, and the sum of the forms required to accurately prepare your return is the basis for your fee. Until we have done your return, we cannot possibly guess what the fee will be. However, we can say that our rates are very competitive with similar firms offering similar depth of service, education and support. Our prices are not the cheapest (unlicensed preparers practicing out of their homes are usually less expensive), but they are far from the highest. We know this because we look at what our new clients paid other preparers for returns (it is a tax deduction, after all!) Often, our fees for essentially the same return are less. Again, your situation is unique to you, and each year is unique from the prior year. Your fees will vary from these numbers. We provide these figures simply to give you a guideline of what to expect.

Q: What do I need to bring to a tax appointment?

A: We have a list of items to bring you can download by clicking here https://7daytaxrelief.com/personal-tax-document-preparation-checklist/

Q: How long does it take to get my taxes finished?

A: Generally, returns are completed during your initial appointment of about an hour. Sometimes, we find additional information is required and will send you home with homework. Depending on your homework, you may be able to drop it off for completion as our schedules allow, or you might wish to schedule a short follow-up appointment for completion. Complicated returns involving businesses or many rental properties may take longer and may require dropping off the business information before your appointment so we can prepare that portion of the return in advance.

Q: How long does it take to get my refund?

A: The IRS used to publish a list of dates correlating filing dates with refunds. For a variety of reasons, this has changed. Starting in 2017, by law, the IRS cannot process refunds for people who claim the child tax credit or the earned income credit until February 15 at the earliest. This can mean the actual refunds are delayed until February 27 or later. For persons not claiming these credits, the IRS is stating that roughly 90% of filers with refunds will receive them in 21 days or less. You can track your refund once it is accepted by the IRS using the “Where’s My Refund?” tracker on the IRS website or the IRS2Go app for your smartphone.

Q: Do you efile?

A: YES! We strongly believe in the benefits of electronic filing. Electronic filing is the fastest, safest way to file your return. According to statistics previously provided by the IRS, there is nearly a 20% error rate on mailed in returns keyed into the system by the IRS, while electronically filed returns have less than a 1% error rate.

Q: When is my return filed?

A: We transmit your return when we have all required documentation and the return is completed. Your return is not considered completed until payment is received or other arrangement is made, such as a Refund Advantage product to pay your fees from your refund. The required documentation that must be signed and returned to us includes: the engagement letter, our due diligence forms, and the “Authorization to Electronically File” Form 8879. We will also require any supporting documents needed to claim a refundable credit, such as Earned Income Tax Credit, Child Tax Credit or the American Opportunity Credit.

Q: How long should I keep my tax records?

A: The Internal Revenue Service can audit back three years, and the State of California Franchise Tax Board can audit back four years. Both agencies can go back additional years, should they desire, if they find errors on the returns they audit and wish to inspect prior years for the same issues. In the case of fraud or suspicion of fraud, both agencies can go back an unlimited number of years. For these reasons, we suggest you keep all records required to support your tax returns for at least four years past the date of filing. Because certain items have an impact on tax returns far beyond this time span, any items being depreciated, as well as records supporting assets, such as your house, should be kept until at least four years beyond the filing date for the year in which you dispose of the item. If you have any carry forward net operating losses or credits, you should keep all returns and records supporting these figures for at least four years past the filing date of the last return to claim any of these figures.

Q: What should I do if I receive a notice from the IRS or FTB?

A: Get the letter or notice to us as soon as possible. We will review the notice for accuracy, give you detailed instructions on how to respond, and advise you of our fee to respond on your behalf, if you so desire. These notices are not always correct. Common notices, such as the CP2000 notice, suggest changes to your return, and if not addressed, become bills with penalties and interest applied. Generally, there is a 30 day response time. In the event that you wish to have us handle the matter for you, we will need signed Power of Attorney documents. These Power of Attorney documents are limited in scope to matters dealing solely with your taxe, and are limited to just the forms and time periods specified on the documents. Generally, these documents do not allow us to sign anything on your behalf. In fact, if you wish to have us sign certain IRS documents, and we are willing to take on this responsibility for you, a special area of the form needs to be addressed.

Q: Can I just drop off or mail in my tax information?

A: Yes! However, in order to accurately prepare your taxes, we will still ask that you complete our annual questionnaire (to make sure we do not miss anything and to honor our due diligence requirements with the IRS), and we will ask that you sign our engagement letter. Why? Because the engagement letter spells out our mutual expectations of one another.

Q: I experienced a short sale, foreclosure, or modification involving principal forgiveness. Will I owe taxes on this?

A: Mortgage Debt Forgiveness, foreclosure or short sale MAY involve taxable income. Every situation is different, and many circumstances need to be considered. The short answer is maybe. If you have had this experience or are considering going through this process, contact us for a FREE consultation to evaluate your circumstances. Debt forgiveness on a tax return is a complicated process to determine the correct outcome. Sadly, we have seen many tax returns professionally prepared incorrectly. Laura Strombom EA, MBA, NTPI Fellow, has taken significant continuing education on this topic and even wrote an article for her peers published by the NAEA Journal. You can request a copy of the article when you contact us!

Q: I filed my tax return on XX date, I still have not received my refund.

A: This one has many possible issues: Was there an offset on the return that caused the refund to go to pay another debt? If that is a possibility, you need to call the IRS debt offset department at 800-304-3107. Has the right amount of time passed? Confirm the date your return was accepted and make sure you really are due you refund now. If it has been more than 3 weeks and you have verified that the return was accepted, call the IRS at 800-829-4477. Did the refund go to the right place? Verify the address on the return. If direct deposit, verify the routing number and account number and type of account. Sometimes, people forget they went direct deposit and need to check with their bank. I got my federal or state refund but not the other. They do not come together. Federal refunds are generally received within 21 days of acceptance and State of California refunds within 14 days of acceptance.

Q: What if I cannot pay all that I owe in taxes?

A: There are many options: installment agreements, paying by credit cards, offer in compromise or even being considered currently not collectible. The most important thing to do is file, and then arrangements can be made to pay if needed.

Q: Can you help me file back taxes?

A: Yes! We can help you complete any tax unfiled tax returns back as far as you need to go! Generally, the IRS is only looking for the past 4 years, but if you need to do an Offer In Compromise or discharge the taxes in bankruptcy, all returns need to be filed. California is also far more aggressive at collecting for up to 20 years.

Q: Can you file for states other than California?

A: Yes! We literally have clients all over the world! Many we have never met with face-to-face. We correspond via our portal and email, and we do phone appointments. We are looking at adding services such as GoToMeeting and/or Skype to be able to do more virtual appointments.

Q: How long have you been preparing tax returns?

A: 29 years

Q: Are you open and available year-round?

A: Our tax preparers are available year-round to help you as needed.

Q: Will I be receiving my refund directly (i.e., through the mail or direct deposit)?

A: Refunds should come to you directly, and direct deposit is the fastest and safest way to get your refund.

Q: Will you provide me with a copy of my completed tax return and return any original documents I provided?

Q: Will you be signing the tax return as a preparer? May I see proof of your PTIN?

A: Yes. All signing preparers are required to have a PTIN.

Q: Do you have a professional license? If so, may I see proof, including current status?

A: Yes. CTEC, PTIN. EFIN

Q: How do you learn about new tax laws?

A: The best answer is through continuing education.

Q: How can I reduce my tax bill?

A: