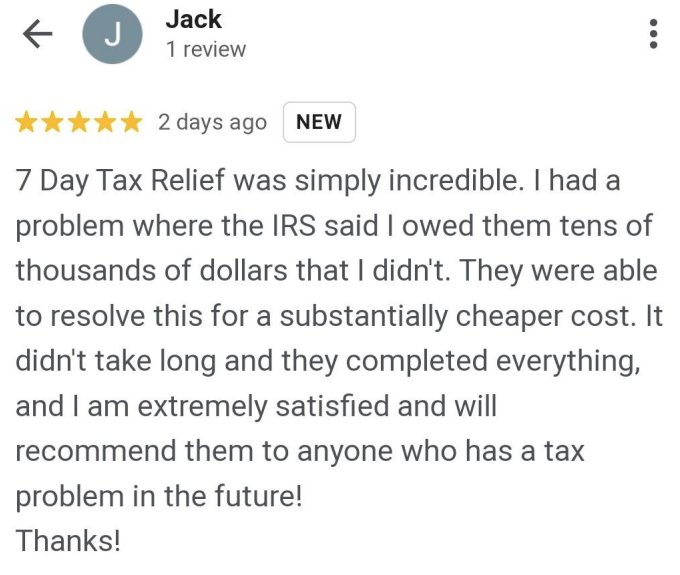

Trust

Licensed

Tax Preparer Registration with the California Tax Education Council A346653

Tax Preparer Registration with the California Tax Education Council A346653

Background checked

The business and one or more owners or managers were background checked

The business and one or more owners or managers were background checked

Call Now For More Information 800-766-1922

FREE CONSULTATION & NO OBLIGATION

Our Process

Step 1:

FREE Consultation

Step 2:

Investigation

Research and protection

From IRS garnishments

and bank levies

Step 3:

Results

Resolved IRS issues

placing you on the path

to Tax Freedom

Tax Debt is Heavy. Don’t Carry it Alone. We are here to help!

Learn about the different programs you qualify for and lower your debt obligation with the IRS or perhaps get a fresh start – 100% free consultation.

Get help as needed from the most experienced Enrolled Agents, Certified Public Accountants (CPAs), Tax Professionals and Tax Attorneys.

Let a skilled tax specialist talk to the IRS and stop them in their tracks while they build your case and find a resolution.

It’s hard to resolve IRS debt by yourself, as there are Tax Court Findings, Revenue Rulings, and Congressional Reports to consider.

We can Help!

|

|

THE TRUTH ABOUT YOUR TAX DEBT

There are approximately 8 million* individuals and business owners who have tax debt, and the IRS is going after them with unprecedented levels of aggression—for instance, property seizures have increased by 230%** in the last decade.

- The IRS likely has access to all of your financial information, including both personal and business assets.

- Evading tax debt can come with very heavy prices: felony conviction, 5 years imprisonment, fines as high as $250,000 and the expensive cost of prosecution***(26 USC 7201).

- The IRS intends to revoke and deny passports to delinquent taxpayers under a new law called FAST Act (new section 7345 of the tax code).

- If a taxpayer has assets and owes back taxes, then that tax debt takes priority, in the eyes of the IRS, over everything else, including your home, cars, investments, business and paycheck.

These days, it’s more important than ever to have an advocate who can take the IRS head-on, armed with a vast knowledge of the tax debt relief programs that can save you thousands. Dealing with the IRS can be daunting, so having representation that works with the IRS all the time and knows how to negotiate on your behalf can get you the best results.

*source: investopedia.com/articles/personal-finance/021214/why-do-so-many-people-fall-behind-their-taxes.asp

*source: businessinsider.com/why-8-million-people-pay-taxes-late-2014-2

**source: The IRS Data Book comparison of 2011 vs. 2001- property seizures increased a 230%

***source: tax.findlaw.com/tax-problems-audits/income-tax-fraud-vs-negligence.html

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Tax Debt

If you’re experiencing or worried about liens, garnishments, penalties, or more, now is the time to learn about your options to take care of your tax debt. Tax debt relief programs under federal guidelines could help

Avoiding Your Tax Debt is a Prosecutable Felony Ignoring the IRS may be very costly:

| Legal Fees to Defend Your Prosecution*($250 X 40 Hours) | $10K |

| Pay IRS Back for Cost of Prosecution | $10K |

| Seizure of Your Home(Equity), Cars,Business and Investments** | $50K |

| Tax Avoidance Fine*** | $250K |

| Loss of Income from 5 Years of Imprisonment($46K/Year)**** | $230K |

| Total Potential Cost Impact | $550K |

Individual results may vary based on ability to save funds and completion of all program terms. Program does not assume any debts nor provide legal or tax advice. Read and understand all terms prior to enrollment. Not available in all states. Sources: ExpertLaw.com*, Bloomberg**,IRS***, Social Security Administration****

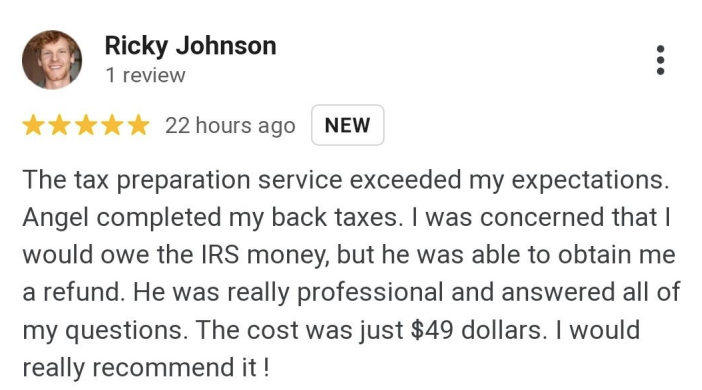

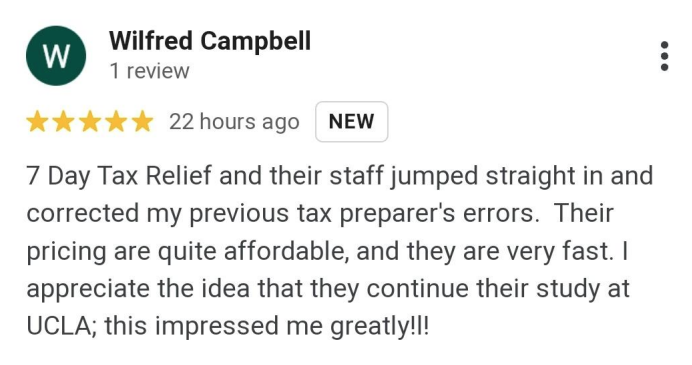

We’ve Got Your Back

When the IRS has such a relentless hold on your life, it’s easy to feel utterly powerless. Our mission is to restore your power. The IRS is a fearful agency, but they understand that they need to offer taxpayers the opportunity to pay what they can afford, while still allowing the taxpayer to care for their basic needs. Get the timely advice you need to stop the IRS in its tracks and you may be able to substantially lower your debt obligation as well.

7 Day Tax Relief FAQs

1. **What does “The IRS Writes Off Millions Annually” mean?**

– This section addresses the potential for individuals to qualify for a fresh start in dealing with unpaid taxes. It’s designed to help you understand if you may be eligible for IRS debt relief.

2. **How can I determine the amount of unpaid tax I owe?**

– Fill out the form on our website with your details, including the amount owed and the type of taxes owed (personal). Our team will get back to you shortly to discuss your situation.

3. **What services does 7 Day Tax Relief offer for IRS debt relief?**

– We specialize in assisting with tax levies & liens, wage garnishment, asset seizure, tax preparation & extensions, IRS ‘Fresh Start’ qualification, filing returns for unfiled years, IRS audit defense, and handling both business and personal taxes.

4. **How does the free consultation process work at 7 Day Tax Relief?**

– Our free consultation involves three steps: consultation, investigation (research and protection from IRS garnishments and bank levies), and results (resolving IRS issues, placing you on the path to Tax Freedom).

5. **Why is it crucial to address tax debt promptly?**

– Approximately 8 million individuals and business owners have tax debt, and the IRS is becoming more aggressive. Ignoring tax debt can lead to severe consequences, including property seizures, legal fees, fines, and imprisonment.

6. **What are the potential costs of avoiding tax debt resolution?**

– Ignoring IRS debt can result in legal fees, repayment for the cost of prosecution, seizure of assets (home, cars, business, investments), tax avoidance fines, and loss of income from imprisonment.

7. **How can 7 Day Tax Relief assist in addressing IRS debt?**

– Our team of Enrolled Agents, Certified Public Accountants (CPAs), Tax Professionals, and Tax Attorneys are equipped to resolve IRS issues, providing timely advice to stop the IRS in its tracks and potentially substantially lower your debt obligation.